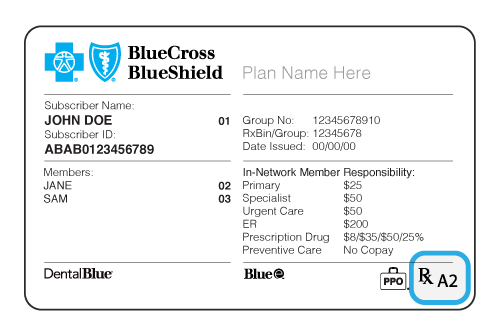

- Blue Cross Blue Shield Ppo Copay

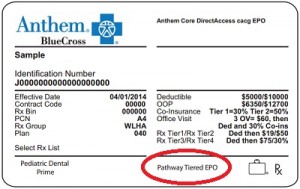

- Anthem Blue Cross Preferred Ppo

- Is Anthem Blue Cross Ppo Good Insurance

- Anthem Blue Cross Ppo Plan

- Anthem Blue Cross Ppo Providers

The percentage copay for non -emergency services from non Anthem Blue Cross PPO providers is based on the scheduled amount. The dollar copay applies only to the visit itself. An additional 20% copay applies for any services performed in office (i.e., X-ray, lab, surgery), after any applicable deductible. $150 copay and then 25% coinsurance This is for the hospital/facility charge only. The ER physician charge may be separate. Copay waived if admitted Emergency Medical Transportation 25% coinsurance 25% coinsurance –––––––––––none––––––––––– Urgent Care $25 copay per visit 50% coinsurance.

About Anthem Blue Cross

Anthem Blue Cross offers the health insurance coverage and choices you – and your employees – want and need. You can select from a variety of plan types, including HMO, PPO, EPO, and Health Savings Account-compatible plans. Anthem has the largest provider network in the nation (and in California), so you're likely to find that your preferred doctor is already in-network – saving you money and time.

Don't forget about Anthem's smart tools designed to help employees make the most of their group health benefits. It's easy to find a doctor, access your virtual ID card, or get plan information, claims data, and other info with the Anthem Anywhere mobile app. Click below to explore the details on any of the Anthem plans available through CaliforniaChoice.

Quick Plan Highlights

Below are some of our most popular Anthem Blue Cross health plans along with a snapshot of plan coverage and out-of-pocket costs. For a complete list of coverage options, click Download All Plans below to see the most current plan information.

| Network | Prudent Buyer - Small Group |

|---|

| Calendar Year Deductible | $1,350 / $2,700 | Out of Network$500 / $1,500 | Out of Network$5,600 / $11,200 (combined Med/Rx/Pediatric dental ded)(applies to Max OOPM) |

|---|

| Out-of-Pocket Max Ind/Fam: | $8,000 / $16,000 |

|---|

| Dr. Office Visit (PCP): | $65 Copay (first 3 visits) - $65 Copay |

|---|

| Urgent Care: | 60% |

|---|

| Emergency Room | $300 Copay - 60% |

|---|

| Network | Advantage PPO | Out of Network |

|---|

| Calendar Year Deductible | $2,700 / $5,400 |

|---|

| Out-of-Pocket Max Ind/Fam: | $7,900 / $15,800 | $15,800 / $31,600 |

|---|

| Dr. Office Visit (PCP): | $40 Copay (ded waived) | 50% |

|---|

| Urgent Care: | $80 Copay (ded waived) | 50% |

|---|

| Emergency Room | $350 Copay - 60% |

|---|

| Network | Advantage PPO | Out of Network |

|---|

| Calendar Year Deductible | $2,000 / $4,000 |

|---|

| Out-of-Pocket Max Ind/Fam: | $6,000 / $12,000 | $12,000 / $24,000 |

|---|

| Dr. Office Visit (PCP): | $30 Copay (ded waived) | 50% |

|---|

| Urgent Care: | $60 Copay (ded waived) | 50% |

|---|

| Emergency Room | $250 Copay - 80% |

|---|

| Network | Select HMO |

|---|

| Calendar Year Deductible | None |

|---|

| Out-of-Pocket Max Ind/Fam: | $2,200 / $4,400 |

|---|

| Dr. Office Visit (PCP): | $15 Copay |

|---|

| Urgent Care: | $15 Copay |

|---|

| Emergency Room | $200 Copay |

|---|

* All services are subject to the deductible unless otherwise stated. Shifter dnd.

Opera GX is a gaming-oriented counterpart of Opera web browser for Microsoft Windows and macOS, developed by Opera Software AS. Opera GX was announced on June 11, 2019, the same day as the start of E3 2019. As of March 2021, it is in open Early Access. Opera GX is a special version of the Opera browser built specifically to complement gaming. It lets gamers control their computer's CPU and memory usage to make gaming and streaming smoother. It features Twitch integration and numerous customization options. Read about Crypto Wallet, Web 3, the Opera GX gaming browser and what's coming soon from Opera. Latest mobile blog posts. Read about our design award-winning mobile browsers, synchronization between devices and other improvements. Get the latest updates and news, and find out what's in the works for mobile browsers at Opera. Opera browser for gaming desktop. The first gaming browser. Opera for Windows. Download now Download the offline package: 64 bit / 32 bit This is a safe download from opera.com Opera for Mac. Download now Prefer to install Opera later? Download the offline package. The first gaming browser. Opera GX is a special version of the Opera browser built specifically to complement gaming. The browser includes unique features to help you.

Get a Quote

View More Carriers

The CaliforniaChoice employee benefits program lets your employees select health plans (HMO, PPO, HSA, and more) from nine of California's top carriers while you determine how much your

company will contribute.

Click on any of the logos below to learn more about our carrier partners

Jump to:

Anthem MediBlue Access Core (PPO) H4036-016 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Anthem Blue Cross and Blue Shield available to residents in Wisconsin. This plan does not provide additional Medicare prescription drug (Part-D) coverage. The Anthem MediBlue Access Core (PPO) has a monthly premium of $0 and has an in-network Maximum Out-of-Pocket limit of $5,500 (MOOP). This means that if you get sick or need a high cost procedure the co-pays are capped once you pay $5,500 out of pocket. This can be a extremely nice safety net.

Anthem MediBlue Access Core (PPO) is a Local PPO *. A preferred provider organization (PPO) is a Medicare plan that has created contracts with a network of 'preferred' providers for you to choose from at reduced rates. You do not need to select a primary care physician and you do not need referrals to see other providers in the network. Offering you a little more flexibility overall. You can get medical attention from a provider outside of the network but you will have to pay the difference between the out-of-network bill and the PPOs discounted rate.

Anthem Blue Cross and Blue Shield works with Medicare to provide significant coverage beyond Part A and Part B benefits. If you decide to sign up for Anthem MediBlue Access Core (PPO) you still retain Original Medicare. But you will get additional Part A (Hospital Insurance) and Part B (Medical Insurance) coverage from Anthem Blue Cross and Blue Shield and not Original Medicare. With Medicare Advantage Plans you are always covered for urgently needed and emergency care. Plus you receive all of the benefits of Original Medicare from Anthem Blue Cross and Blue Shield except hospice care. Original Medicare still provides you with hospice care even if you sign up for a Medicare Advantage Plan.

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Fri 8am-9pm EST

Sat 9am-9pm EST

2021 Anthem Blue Cross and Blue Shield Medicare Advantage Plan Costs

| Name: |

|---|

| Plan ID: | H4036-016 |

|---|

| Provider: | Anthem Blue Cross and Blue Shield |

|---|

| Year: | 2021 |

|---|

| Type: | Local PPO * |

|---|

| Monthly Premium C+D: | $0 |

|---|

| Part C Premium: |

|---|

| MOOP: | $5,500 |

|---|

| Similar Plan: | H4036-017 |

|---|

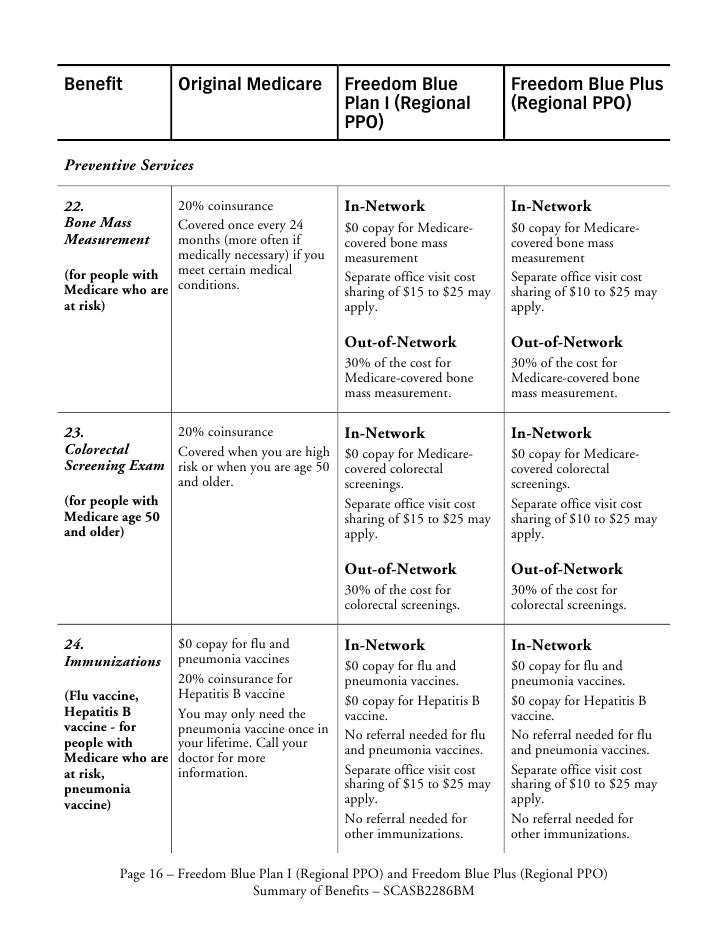

2021 Anthem MediBlue Access Core (PPO) Summary of Benefits

Additional Benefits

Comprehensive Dental

| Diagnostic services | $0 copay |

|---|

| Diagnostic services | $0 copay (Out-of-Network) |

|---|

| Endodontics | $0 copay |

|---|

| Endodontics | $0 copay (Out-of-Network) |

|---|

| Extractions | $0 copay |

|---|

| Extractions | $0 copay (Out-of-Network) |

|---|

| Non-routine services | $0 copay |

|---|

| Non-routine services | $0 copay (Out-of-Network) |

|---|

| Periodontics | $0 copay |

|---|

| Periodontics | $0 copay (Out-of-Network) |

|---|

| Prosthodontics, other oral/maxillofacial surgery, other services | $0 copay |

|---|

| Prosthodontics, other oral/maxillofacial surgery, other services | $0 copay (Out-of-Network) |

|---|

| Restorative services | $0 copay |

|---|

| Restorative services | $0 copay (Out-of-Network) |

|---|

Deductible

Diagnostic Tests and Procedures

| Diagnostic radiology services (e.g., MRI) | $130-215 copay |

|---|

| Diagnostic radiology services (e.g., MRI) | 35% coinsurance (Out-of-Network) |

|---|

| Diagnostic tests and procedures | $0-150 copay |

|---|

| Diagnostic tests and procedures | 35% coinsurance (Out-of-Network) |

|---|

| Lab services | $0-10 copay |

|---|

| Lab services | 35% coinsurance (Out-of-Network) |

|---|

| Outpatient x-rays | $50-110 copay |

|---|

| Outpatient x-rays | 35% coinsurance (Out-of-Network) |

|---|

Doctor Visits

| Primary | $40 copay per visit (Out-of-Network) |

|---|

| Primary | $5 copay per visit |

|---|

| Specialist | $40 copay per visit |

|---|

| Specialist | $60 copay per visit (Out-of-Network) |

|---|

Emergency care/Urgent Care

| Emergency | $90 copay per visit (always covered) |

|---|

| Urgent care | $35 copay per visit (always covered) |

|---|

Foot Care (podiatry services)

| Foot exams and treatment | $0-40 copay |

|---|

| Foot exams and treatment | $60 copay (Out-of-Network) |

|---|

| Routine foot care | $0 copay |

|---|

| Routine foot care | $60 copay (Out-of-Network) |

|---|

Ground Ambulance

| $265 copay |

|---|

| $265 copay (Out-of-Network) |

|---|

Hearing

| Fitting/evaluation | $0 copay |

|---|

| Fitting/evaluation | 20% coinsurance (Out-of-Network) |

|---|

| Hearing aids | $0 copay |

|---|

| Hearing aids | 50% coinsurance (Out-of-Network) |

|---|

| Hearing exam | $40 copay |

|---|

| Hearing exam | $60 copay (Out-of-Network) |

|---|

Inpatient Hospital Coverage

$295 per day for days 1 through 7

$0 per day for days 8 through 90 |

|---|

| 50% per stay (Out-of-Network) |

|---|

Medical Equipment/Supplies

| Diabetes supplies | $0 copay |

|---|

| Diabetes supplies | 40% coinsurance per item (Out-of-Network) |

|---|

| Durable medical equipment (e.g., wheelchairs, oxygen) | 0-20% coinsurance per item |

|---|

| Durable medical equipment (e.g., wheelchairs, oxygen) | 40% coinsurance per item (Out-of-Network) |

|---|

| Prosthetics (e.g., braces, artificial limbs) | 20% coinsurance per item |

|---|

| Prosthetics (e.g., braces, artificial limbs) | 40% coinsurance per item (Out-of-Network) |

|---|

Medicare Part B Drugs

| Chemotherapy | 20% coinsurance |

|---|

| Chemotherapy | 40% coinsurance (Out-of-Network) |

|---|

| Other Part B drugs | 20% coinsurance |

|---|

| Other Part B drugs | 40% coinsurance (Out-of-Network) |

|---|

Mental Health Services

Blue Cross Blue Shield Ppo Copay

| Inpatient hospital - psychiatric | $250 per day for days 1 through 7

$0 per day for days 8 through 90 |

|---|

| Inpatient hospital - psychiatric | 50% per stay (Out-of-Network) |

|---|

| Outpatient group therapy visit | $40 copay |

|---|

| Outpatient group therapy visit | $60 copay (Out-of-Network) |

|---|

| Outpatient group therapy visit with a psychiatrist | $40 copay |

|---|

| Outpatient group therapy visit with a psychiatrist | $60 copay (Out-of-Network) |

|---|

| Outpatient individual therapy visit | $40 copay |

|---|

| Outpatient individual therapy visit | $60 copay (Out-of-Network) |

|---|

| Outpatient individual therapy visit with a psychiatrist | $40 copay |

|---|

| Outpatient individual therapy visit with a psychiatrist | $60 copay (Out-of-Network) |

|---|

MOOP